how to buy tax liens in maricopa county

Arizona Tax Auction Update. Tax lien investing is the act of buying the delinquent tax lien on a property and earning profits as the property owner pays interest on the certificate or from the liquidation of the collateral.

Report Phoenix Area S Eviction Foreclosure Rates Double U S Average

In fact the rate of return on property tax liens investments in Maricopa County AZ can be anywhere between 15 and 25 interest.

. You can now map search. Tax Deeded Land Sales. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax.

4 counties in Arizona have now released their property lists in preparation for the 2022 online tax lien sales. Can you buy tax liens in Arizona. Find the best deals on the market in Maricopa County County AZ and buy a property up to 50 percent below market value.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties. Upon receipt of a cashiers check or certified funds the Department of Revenue will immediately provide a Notice of Intent to Release State Tax. Tax deeded land sales are conducted by the Maricopa County Treasurers Office on an as-needed basis with Maricopa County acting as the agent for the.

Learn to buy tax liens in Maricopa County AZ. In Maricopa county if a property owner does not pay property taxes the local county will issue a tax lien certificate. A Arizona tax lien certificate transfers all the rights that come with being the owner of the real estate tax lien from Pinal County Arizona to the.

Please mail completed forms to Maricopa County Treasurer 301 W Jefferson St 140 Phoenix AZ 85003 or fax to 602 506-1102. The tax on the property is auctioned in open competitive bidding based on the least percent of interest. Maricopa County AZ currently has 8 tax liens available as of November 20.

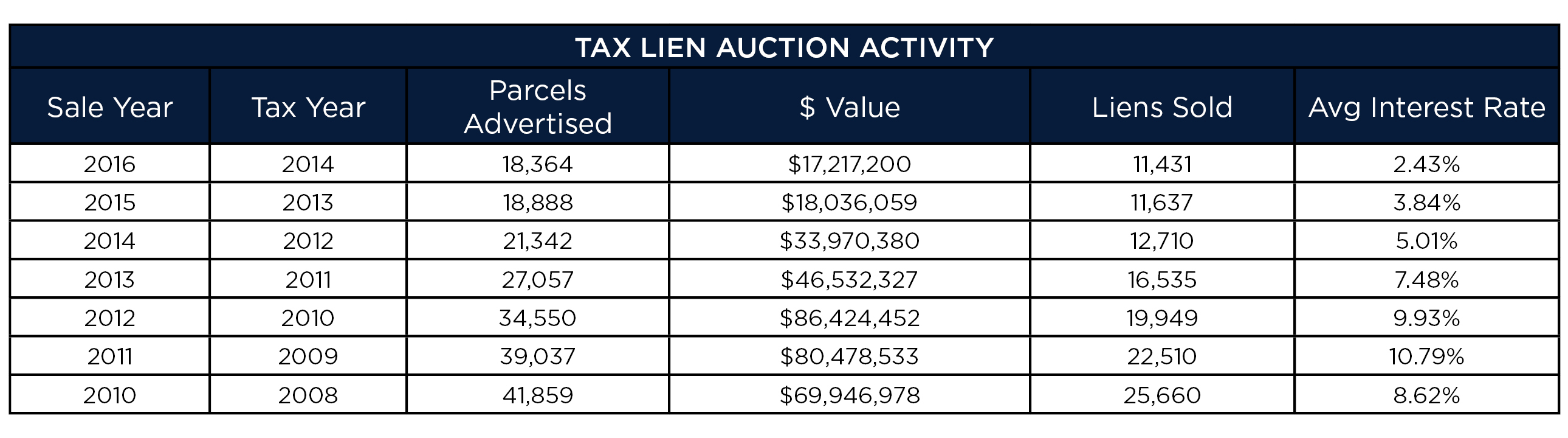

The Tax Lien Sale provides for the payment of delinquent property taxes by an investor. Maricopa County AZ currently has 18613 tax liens available as of November 24. A tax lien is simply a claim for taxes.

A number will be assigned to each bidder for use when. Maricopa County County AZ tax liens available in AZ. Payment in full with Cash or Certified Funds.

Directing the Maricopa County Arizona Treasurer to execute and deliver to the purchaser of the Maricopa County Arizona tax lien certificate in whose favor the judgment is entered including.

The Basics Of Tax Lien Season Arizona School Of Real Estate And Business

A Conversation With Charles Hos Hoskins Former Maricopa County Treasurer

How To Buy Tax Liens In Maricopa County Youtube

2022 Elections Battlegrounds To Watch Maricopa County Arizona Politico

Maricopa County Assessor S Office

How To Buy Tax Liens In Maricopa County Youtube

How To Buy Tax Liens In Maricopa County Youtube

Pha Annual Plan 2021 2022 Housing Authority Of Maricopa County

Eastmark No 1 Eastmark No 2 And Cadence Cfd City Of Mesa

How To Buy Tax Liens In Maricopa County Youtube

Gis Mapping Applications Maricopa County Az

Arizona Owners Can Lose Homes Over As Little As 50 In Back Taxes

Job Opportunities Sorted By Job Title Ascending Maricopa County

How To Buy Tax Liens In Maricopa County Youtube

The Statutory Requirements For Purchasing Redeeming And Foreclosing On Tax Liens In Arizona Provident Lawyers

Tax Lien Investments And Foreclosures Rose Law Group

Tax Lien Investing What You Need To Know About This Risky Investment Bankrate