nj tax clearance certificate dissolution

Contact Spiegel Utrera PA. You may be responsible for annual reports and fees in each state for the year in which you dissolved your LLC.

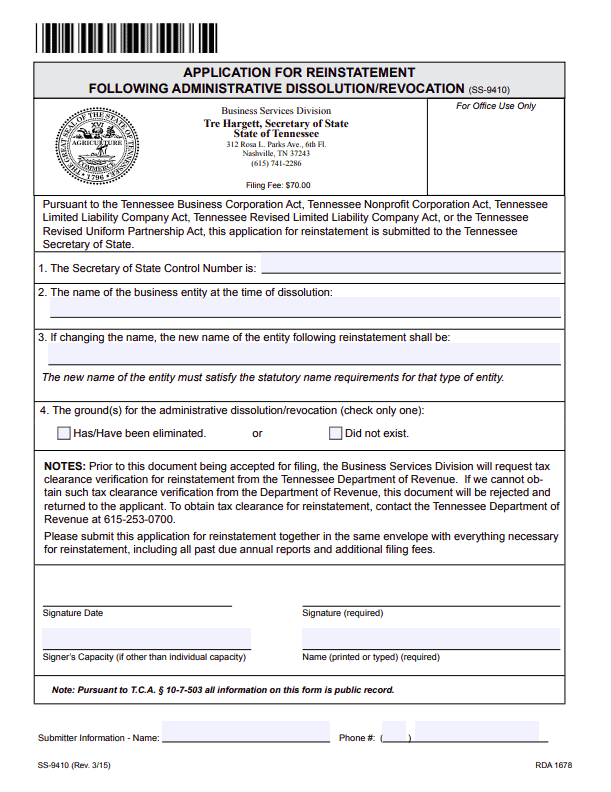

Free Guide To Reinstate Or Revive A Tennessee Limited Liability Company

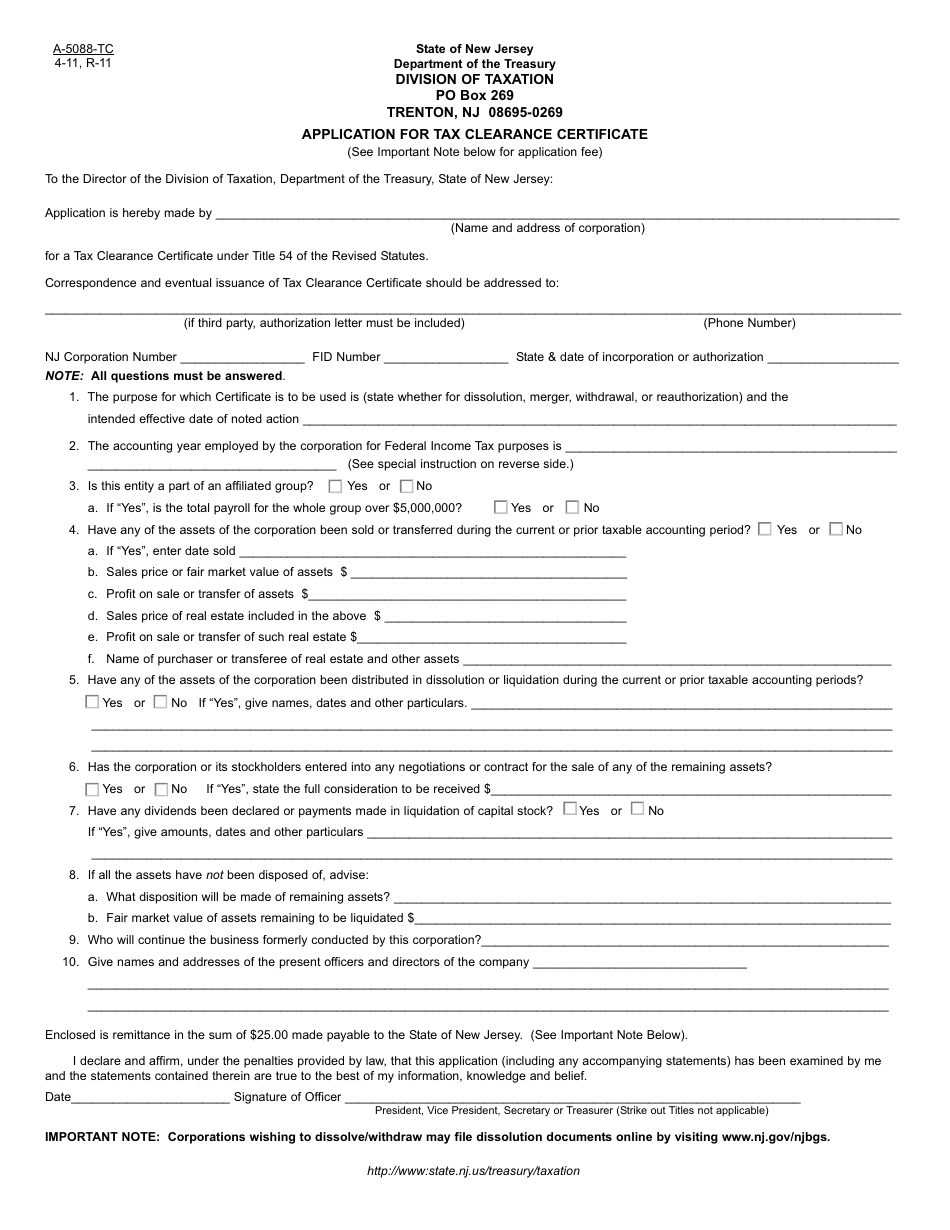

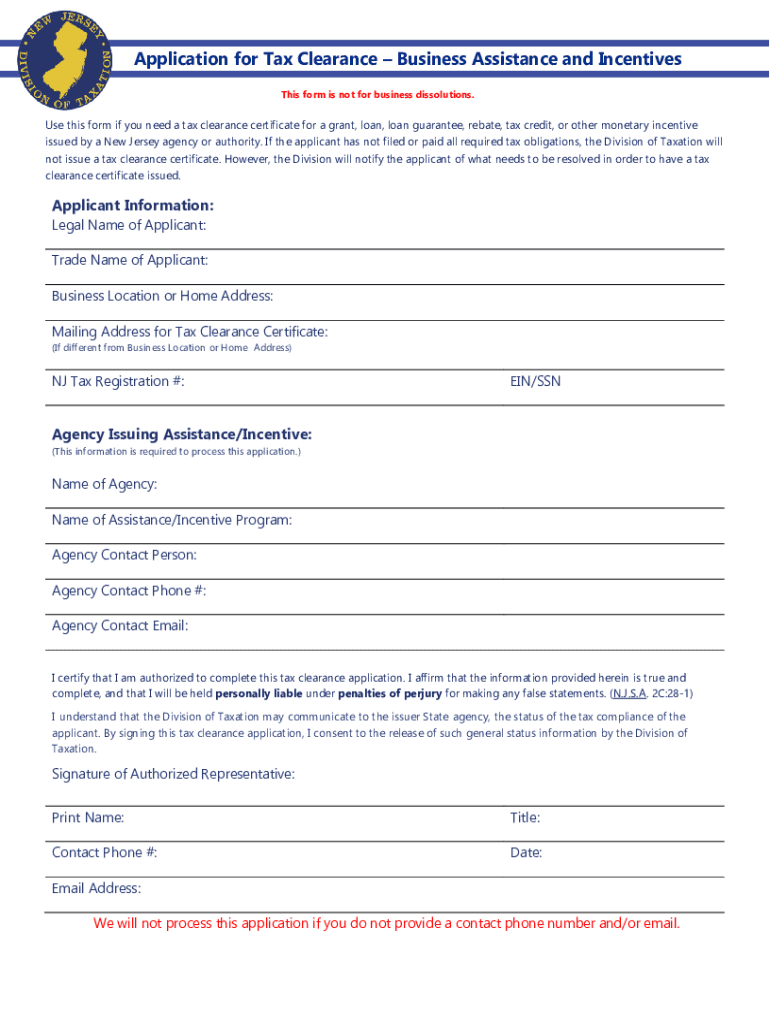

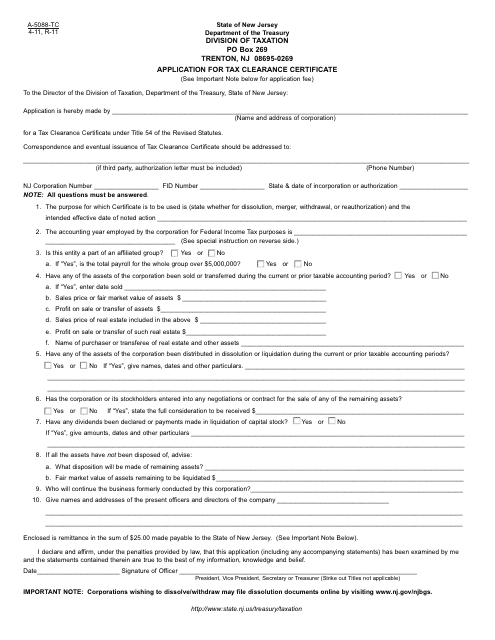

You will also need to include Form A-5088-TC Application for Tax Clearance Certificate and Form A-5052.

. When the Corporate Dissolution is Effective in NJ. New Jersey requires several steps to dissolve an LLC. Walk-in filings have to pay another 25.

6 Second the corporation must submit a Form A-5088-TC. Here are the steps to address for dissolving New Jersey LLC. For a Tax Clearance Certificate under Title 54 of the Revised Statutes.

First of all you must obtain a tax clearance certificate. A New Jersey corporation has to pay a 120 filing fee which includes 95 for the dissolution filing and 25 for the tax. You can also dissolve a New Jersey corporation by submitting the appropriate Certificate of Dissolution form in duplicate to the New Jersey Division of Revenue.

New Jersey offers grants incentives and rebates to businesses and every recipient must obtain a business assistance tax clearance certificate from the Division of Taxation. This requires that your LLC be in good standing with the New Jersey. For a free consultation and guidance through.

To request the issuance of a tax certification for a withdrawal cancellation dissolution or good standing the Form AU-22 Certification Request Form must be completed in full and submitted. Signature of the Chairman of the Board President or Vice President. The Tax Clearance Certificate is evidence that the requisite corporation.

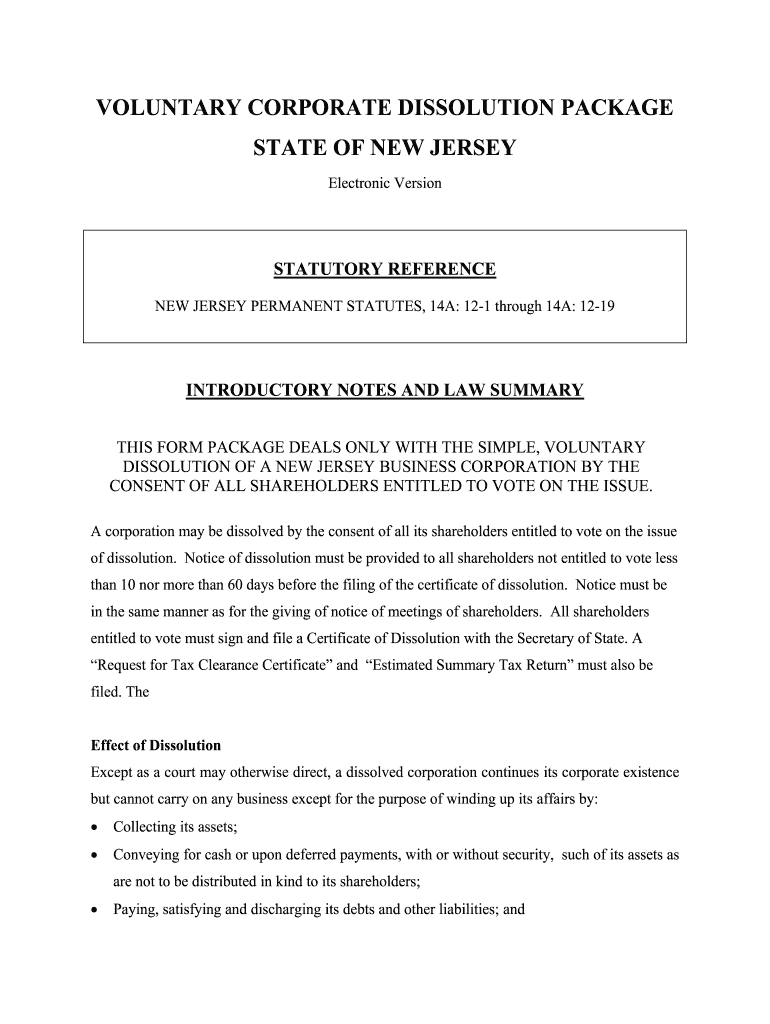

Instructions for filing tax returns can be found on the form Procedure for Dissolution Withdrawal or Surrender. A dissolution shall be considered filed and effective as of the date the Division of Revenue receives the properly. To effect such a dissolution all shareholdersmembers shall sign and file in the Office of the Treasurer Division of Revenue the following articles of dissolution.

Application for Tax Clearance. After casting their vote in favor of the dissolution the legal process must be started. The Tax Clearance Certificate is dated and it voids and becomes a nullity 46 days after that date.

Application For Tax Clearance Certificate State of New Jersey Department of the Treasury Division of Taxation PO. After July 1 2017. The filing fee for LLCs is 100.

First the corporation must pay 120 of which 95 is a dissolution fee and 25 is a tax clearance certificate application fee. How to Dissolve an LLC.

Form A 5088 Tc Download Fillable Pdf Or Fill Online Application For Tax Clearance Certificate New Jersey Templateroller

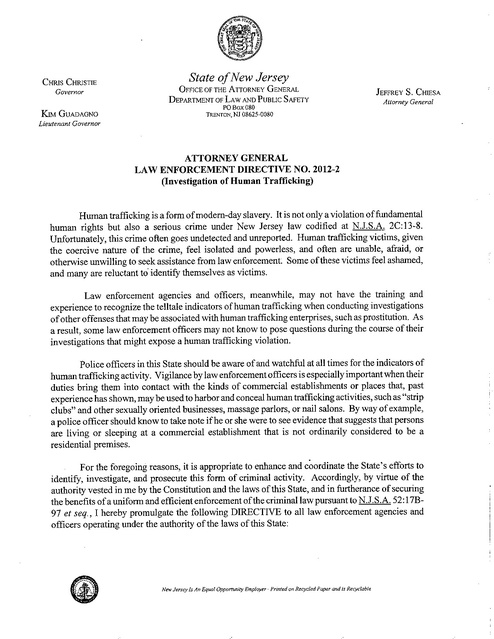

Directives And Procedures Nj Ag 2014 Prison Legal News

Nj Dot Gtb 10 2021 2022 Fill And Sign Printable Template Online Us Legal Forms

Nj A 5088 Tc 2011 2022 Fill Out Tax Template Online Us Legal Forms

How To Dissolve A Corporation Llc Or Nonprofit Harbor Compliance

How To Dissolve An Llc In Pennsylvania 2022 Important Requirements

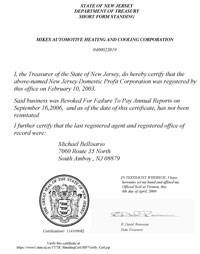

New Jersey Good Standing Certificate Nj Certificate Of Existence

Bill Of Sale Form New Jersey Tax Power Of Attorney Form Templates Fillable Printable Samples For Pdf Word Pdffiller

Form C 159d Certificate Of Dissolution Without A Meeting Of Shareholders

Form A 5033 Tc Procedure For Dissolution Withdrawal Surrender Or Reauthorization

Dissolve Your New Jersey Business Today Zenbusiness Inc

Application For Tax Clearance New Jersey Free Download

New Mexico Good Standing Certificate Nm Certificate Of Existence

Nj Form L 110b Fill Out Sign Online Dochub

Nj Clearance Fill Out And Sign Printable Pdf Template Signnow

Application For Tax Clearance New Jersey Edit Fill Sign Online Handypdf

Form A 5088 Tc Download Fillable Pdf Or Fill Online Application For Tax Clearance Certificate New Jersey Templateroller

Tax Clearance Request Acd 31096 Pdf Fpdf Doc Docx New Mexico